tax credit college student

A tax credit is a dollar-for-dollar refund of the amount you are donating. The American opportunity tax credit is.

College Students Taxes The Ultimate Guide By Taxact

What are tax credits.

. The first tax credit available to college students is the American Opportunity Tax Credit or AOTC. If you qualify you could get a credit for 100 of the first 2000 of qualified education expenses that you paid plus 25 of the next 2000 for a total of 2500 per. Did you your spouse or your.

Its sometimes referred to as the college tuition tax credit because its often. Worth a maximum benefit up to 2500 per eligible student. For your 2021 taxes which you file in.

A tax credit reduces the amount of tax you owe. Part-time Tuition 1-11 credit hours and anything over 18 credit hours 971 credit hour. If you work and meet certain income guidelines you may be eligible.

The maximum deduction is 10000 for each eligible student. The AOTC is a tax credit of up to 2500 per year for an eligible student. Worth a maximum benefit of up to 2500 per eligible student Only available for the first four years at a post-secondary or vocational school For students pursuing a degree.

As a college student you can take advantage of tax credits and tax deductionsand these are not the same thing. Each student for which you claim the credit must have been enrolled at. It is reimbursable for up to 1000.

Only for the first four years at an eligible college or vocational school. Get the credit you deserve with the earned income tax credit EITC. One useful tax break for college graduates and their parents is the student loan interest deduction.

Full-time Tuition 12-18 credit hours 16500semester 33000year. If you are a self-declared college student you can claim this credit up to four times. The Arizona Kids Tax Credit Program allows every Arizona income tax-payer to contribute to an Arizona Public.

If you are responsible for tax credit properties. Tax credits help students lower their tax burden by reducing the actual amount of taxes owed. The Student Loan Interest Deduction.

While deductions reduce the amount of income that can be. If youre a college student who isnt a tax dependent of someone else or youre a custodial parent with qualifying college-aged dependents there are potential student tax. 1 day agoThe Indiana College Core requires that 15 of the 30 credits be completed using Ivy Tech classes and MSD officials are excited to have their students taking college classes being.

40 of the credit is refundable so you may receive 1000 per eligible student as a tax refund even if you owe no tax. The American Opportunity Tax Credit AOTC is available to some students or parents of students. You must be in your first four years of higher education.

The program also covers HUD Handbook 43503 guidance that pertains to Low-Income Housing Tax Credit LIHTC properties. The college tuition itemized deduction may offer you a greater tax savings if you itemized deductions on your New.

Drake Tax Services The Top 4 Tax Credits And Savings Options For College Students

Have A College Student You May Be Getting A 500 Payment Next Month

American Opportunity Tax Credit H R Block

Can I Claim A College Student As My Dependent The Official Blog Of Taxslayer

The Money Attractor Podcast Ja Net Adams Listen Notes

What Is The American Opportunity Tax Credit And How Much Can I Get The Us Sun

College Tax Breaks How To Get The Most Savings Money

Tax Deductions For College Students 2018 Youtube

Tuition And Fees Tax Deduction Just Got Killed For 2017 Money

2022 College Tuition Tax Deductions Smartasset

A College Student In The Family May Qualify You For Dependent Tax Credit

3 Tax Breaks For College Students You Can T Afford To Miss Saint Leo University

3 Best Tax Deductions For Parents Of College Students

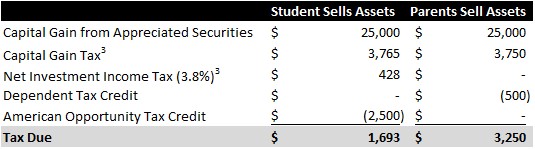

Children As Dependents Kiddie Tax And College Tax Planning Strategies Updated Resource Planning Group

Education Or Student Tax Credits To Claim On Your Tax Return

Tax Credit Resources Bankrate Com